Table of Contents

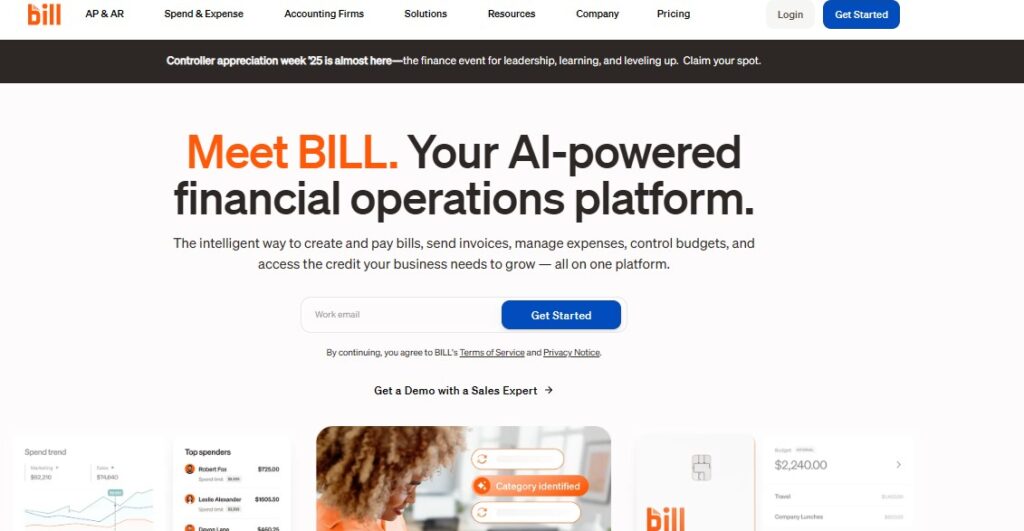

Introduction: Why BILL Has Become the Go-To Financial Automation Tool

Running a modern business requires more than just selling products or managing clients. You have invoices to send, bills to pay, vendors to track, tax records to organize, receipts piling up, and cash flow to monitor. Traditionally, these tasks take hours every week hours that could be spent on growth, sales, or operations.

That’s where BILL (formerly Bill.com) comes in.

BILL is one of the most popular and trusted AP/AR (Accounts Payable & Accounts Receivable) automation platforms, used by more than 400,000 businesses and thousands of accounting firms. The platform helps companies automate bill payments, streamline invoicing, centralize financial workflows, and get paid faster all while reducing manual work.

BILL Review, you’ll learn:

- What BILL actually does

- Its features (AP, AR, Spend, Expense, Bill Pay, Integrations, Cards & more)

- The pros & cons

- Pricing and who it’s best for

- Whether BILL is worth the money

- Why it’s one of the easiest affiliate offers to promote

- How to sign up for a trial

This is the most complete BILL review article you’ll find, and it’s designed to help you make an informed decision before signing up.

What Is BILL? A Modern Financial Automation Platform

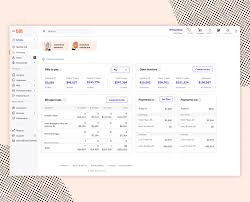

BILL is a cloud-based platform that helps businesses streamline accounts payable, accounts receivable, spend management, and expense tracking. Instead of handling financial paperwork manually, BILL connects payment workflows, automates approvals, syncs with accounting software, and processes transactions with a few clicks.

In simple terms: BILL replaces email + spreadsheets + manual payments with automation.

The platform gives you a single dashboard to:

- Pay vendors & suppliers

- Send invoices & get paid

- Track business expenses

- Manage company cards

- Automate approvals

- Sync data with QuickBooks, Xero, NetSuite, Sage, and more

It works for:

- Solo entrepreneurs

- Small and medium-sized businesses

- Accounting firms

- Bookkeepers

- Finance teams

- Agencies

- Consultants

- E-commerce stores

- Real estate companies

- Medical practices

- Nonprofits

Whether you handle 10 invoices per month or 10,000, BILL keeps everything organized.

Why BILL Matters: The Problem with Traditional AP/AR Workflows

Most businesses still use email and spreadsheets to manage invoices and payments. That means:

- Late payments

- Incorrect invoices

- Missed approvals

- Time wasted chasing vendors or clients

- Manual errors

- Lost receipts

- Duplicate payments

- Slow processing

- Overworked finance staff

BILL eliminates these issues by providing:

- Automated reminders

- Cloud-based workflows

- Real-time syncing with accounting tools

- Error-free data handling

- Faster approvals

- Digital payments

- Audit trails

- Centralized storage

Simply put: BILL saves hours per week and reduces financial errors.

BILL Features Review (Detailed Breakdown)

Below is a complete analysis of the core BILL features, evaluated based on speed, automation, ease of use, and financial accuracy.

1. Accounts Payable (AP) – Automate Vendor & Supplier Payments

This is one of BILL’s strongest features.

What AP automation does:

- Upload or email vendor invoices

- BILL extracts the data automatically

- Assign invoice categories

- Set approval rules

- Schedule payments

- Pay via ACH, check, card, or international transfer

Key Features:

1. Invoice Capture & OCR

Simply take a photo or upload a PDF BILL pulls out the invoice details automatically.

2. Automated Approval Workflows

Set rules such as:

- “Manager approves invoices above $500”

- “CEO must approve vendor payments”

3. Multiple Payment Options

You can pay vendors through:

- Bank transfer

- Virtual card

- Check

- Wire transfer

- International payments

4. Vendor Portal

Vendors can upload invoices directly and track payment status.

5. Fraud Prevention

Built-in authentication and audit trails protect your transactions.

2. Accounts Receivable (AR) – Send Invoices & Get Paid Faster

With BILL, you can send professional invoices and allow clients to pay instantly.

Key AR Features:

1. Customizable Invoices

Add your logo, terms, descriptions, and payment options.

2. Automatic Payment Reminders

No more manually messaging clients.

3. Online Payment Options

Clients can pay through:

- ACH

- Credit card

- Debit card

- PayPal (varies)

4. Customer Portal

Your clients can view outstanding invoices and payment history.

5. Recurring Billing

Great for agencies, subscriptions, and retainers.

3. Spend Management – Control Spending With Virtual & Physical Cards

Spend management is one of BILL’s newest high-value features.

What You Can Do:

- Issue virtual cards to employees

- Set spending limits

- Manage budgets per department

- Track real-time spending

- Prevent unauthorized purchases

This feature helps small businesses maintain financial discipline while empowering employees with controlled access.

4. Expense Management – Perfect for Small Teams & Remote Workforces

Expense tracking is often messy receipts get lost, spreadsheets break, and reimbursements take forever.

BILL solves all that.

Expense Features:

- Mobile app for receipt scanning

- Auto-categorization

- Manager approvals

- Reimbursement automation

- Syncing with accounting tools

Employees love it because it’s easy; managers love it because it saves time; accountants love it because it reduces paperwork.

5. Syncing & Integrations – BILL Works With Your Existing Tools

BILL integrates with over 20 financial tools, including:

- QuickBooks Online & Desktop

- Xero

- NetSuite

- Sage Intacct

- Microsoft Dynamics

Why Syncing Matters:

- No double entry

- Real-time data accuracy

- Clean bookkeeping

- Fewer errors

- Faster month-end close

For accounting teams, this alone is worth the subscription.

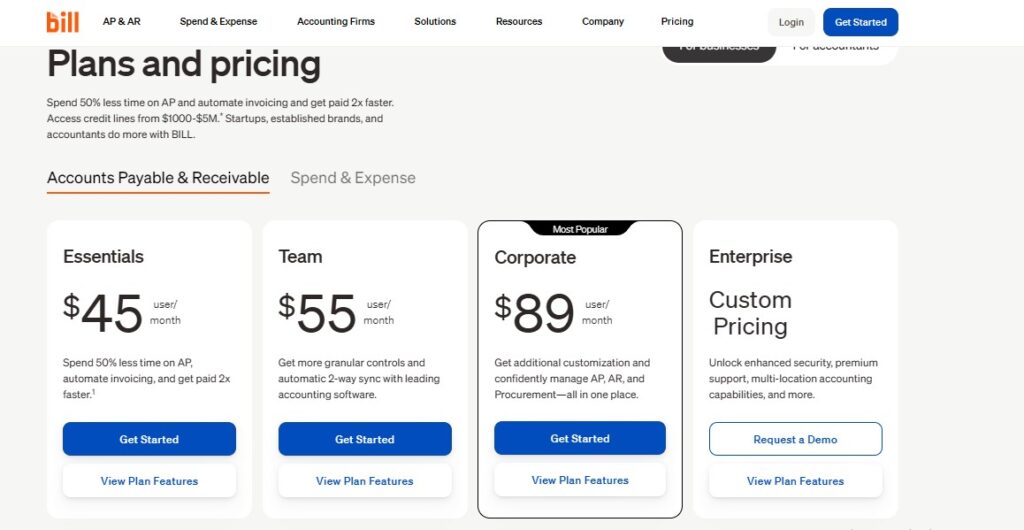

BILL Pricing Review (2025 Updated)

BILL offers multiple product categories: AP, AR, Spend & Expense, and each has its own pricing tier.

Accounts Payable Starting Price:

Approx. $45–$79 per user/month depending on plan and features.

Accounts Receivable Price:

Similar pricing depending on usage.

Spend & Expense:

Typically included when using the card program (fees vary).

Is BILL expensive?

Compared to tools like Melio, Ramp, Payoneer, Expensify, or QuickBooks Bill Pay:

- BILL is more powerful

- BILL offers deeper automation

- BILL includes better syncing & approvals

- BILL provides richer AP/AR workflows

For businesses processing high volumes, BILL saves both time and salary costs—making it worth the investment.

BILL Pros & Cons (Honest Review)

Pros

1. Excellent AP/AR Automation

One of the most advanced tools available.

2. Huge Time Savings

Reduces manual tasks, paperwork, and errors.

3. Perfect for Accountants & Bookkeepers

Automates workflows and allows multi-client management.

4. Strong Integrations

QuickBooks + Xero users will love it.

5. Easy to Use

User-friendly UI, modern dashboard, clean layout.

6. Better Approval Workflows Than Competitors

Great for teams who need structured controls.

7. International Payments

Useful for global vendors.

Cons

1. Higher Pricing vs Basic Tools

Some businesses may prefer cheaper tools like Melio or Wave.

2. Learning Curve for Beginners

Many features = more onboarding time.

3. Fees for Card Payments

As with most invoicing tools.

4. Not the Best Fit for Low-Volume Businesses

If you send only 2 invoices per month, it may be too much.

Who Should Use BILL? (Best Fit in 2025)

BILL is perfect for:

1. Small–Medium Businesses

Especially those paying or receiving frequent invoices.

2. Accounting Firms

Multi-client management + automation = huge time savings.

3. Entrepreneurs & Agencies

Automate client billing & vendor payments.

4. E-commerce Brands

Manage suppliers & expenses easily.

5. Real Estate & Construction

High invoice volume + complex approvals.

6. Healthcare Practices

Centralize expenses & send faster invoices.

Who Should Not Use BILL?

You might skip BILL if:

- You only pay 1–2 vendors per month

- You don’t send invoices regularly

- Your business is extremely small with little financial activity

In those cases, free alternatives might be enough.

Comparison: BILL vs Other AP/AR Tools

BILL vs Melio

Melio is cheaper but limited.

BILL wins for automation, approval workflows, and accounting integrations.

BILL vs Expensify

Expensify is better for receipt tracking;

BILL is better for AP/AR workflows.

BILL vs Ramp

Ramp is excellent for spend management;

BILL is still superior for AP/AR automation.

BILL vs QuickBooks Bill Pay

QuickBooks is simpler;

BILL is more advanced and scalable.

Is BILL Worth It in 2025? (Final Verdict)

Yes BILL is the most powerful, reliable, and feature-rich AP/AR automation tool for small and mid-sized businesses.

If your business:

- Handles invoices

- Pays multiple vendors

- Sends professional invoices

- Works with accounting firms

- Needs approval workflows

- Wants automation

Then BILL will save you hours each week, reduce errors, and improve cash flow.

It’s the best long-term financial automation platform for professional teams.

How to Start Your BILL Trial (Step-by-Step)

Getting started is simple.

Step 1: Visit the Sign-Up Page

Click Bill

Step 2: Create Your Account

Enter:

- Name

- Business email

- Role

- Business name

Step 3: Select Your Modules

Choose:

- Accounts Payable

- Accounts Receivable

- Spend & Expense

Or combine them.

Step 4: Connect Your Bank

This lets you send and receive payments securely.

Step 5: Connect Your Accounting Software

QuickBooks, Xero, NetSuite, etc.

Step 6: Start Using BILL

You can:

- Upload invoices

- Send invoices

- Add vendors

- Automate approvals

- Issue cards

- Track expenses

Your trial is fully functional.

Conclusion — BILL Is the Ultimate Solution for AP/AR Automation

If you’re looking for a platform that:

- Saves time

- Automates financial workflows

- Improves accuracy

- Strengthens approval systems

- Integrates smoothly

- Helps you get paid faster

Then BILL is the best choice

Whether you’re a business owner, freelancer, accounting firm, or bookkeeper, BILL provides everything you need to streamline your financial operations.

Click to Read about Shippo

Pingback: AirSlate the All-In-One Platform Simplifying Contracts, Approvals & Operations - softdatacore