Table of Contents

Discover how Deel simplifies global payroll, contractor management, and EOR services. Learn features, pricing, comparisons, and why businesses choose Deel.

Remote work has redefined how companies build teams. The modern workforce is global, distributed, and digital. Businesses now hire across continents, manage payroll in multiple currencies, and navigate international labor laws daily.

But with opportunity comes complexity.

This is where Deel has positioned itself as a market leader. As a global payroll and compliance platform, Deel enables companies to hire, onboard, and pay contractors and employees in over 150 countries without setting up local entities.

In this in-depth, SEO-optimized guide, we’ll explore everything you need to know about Deel, including features, pricing, compliance, comparisons, use cases, integrations, and expert insights into why it’s dominating the global hiring space.

What Is Deel?

Deel is a global workforce management platform designed to simplify international hiring, payroll, compliance, and HR operations.

It allows companies to:

- Hire contractors worldwide

- Employ full-time international staff through Employer of Record (EOR) services

- Run compliant global payroll

- Automate tax documentation

- Manage HR processes in one centralized dashboard

Instead of establishing foreign subsidiaries, businesses use Deel to handle the legal, administrative, and financial complexities of international employment.

At its core, Deel removes friction from global expansion.

Why Businesses Are Choosing Deel for Global Hiring

Global hiring presents three primary challenges:

- Legal compliance across jurisdictions

- Payroll and tax complexity

- Worker classification risks

Traditional expansion requires months of legal work, entity registration, and banking setup. With Deel, companies bypass those hurdles.

Key reasons businesses choose Deel include:

- Faster international onboarding

- Reduced compliance risk

- Multi-currency payroll automation

- Transparent pricing

- Scalable workforce infrastructure

As remote-first companies continue to grow, Deel provides the operational backbone that supports borderless teams.

How Deel Works

Understanding how Deel operates helps clarify its value proposition.

The process typically follows these steps:

- A company signs up and selects contractor or employee hiring.

- Localized contracts are generated automatically.

- The worker completes onboarding digitally.

- Payroll schedules are configured.

- Payments are processed in preferred currencies.

Behind the scenes, Deel ensures compliance with country-specific labor laws and tax regulations.

This automation dramatically reduces administrative overhead.

Core Features of Deel

Global Contractor Management

Hiring freelancers internationally comes with misclassification risks and tax obligations. Deel provides compliant contracts, automated invoicing, and streamlined payments to contractors worldwide.

Employer of Record (EOR) Services

Through EOR services, Deel legally employs workers on your behalf in foreign countries. This allows companies to:

- Avoid establishing local entities

- Offer statutory benefits

- Ensure labor law compliance

- Expand faster

Automated Global Payroll

Running payroll in multiple countries can be overwhelming. Deel handles:

- Salary calculations

- Tax deductions

- Social contributions

- Payslip generation

- Currency conversions

Compliance & Tax Documentation

Compliance is one of the most critical aspects of international hiring. Deel centralizes tax forms, agreements, and regulatory updates to minimize legal exposure.

HR & Administrative Tools

From time-off tracking to expense management, Deel includes tools that simplify HR operations for distributed teams.

Deel vs Traditional International Hiring

Traditional global hiring often requires:

- Entity registration

- Legal counsel in each country

- Separate payroll providers

- Compliance audits

This process can take months and cost tens of thousands of dollars.

With Deel, companies can hire in days not months.

Instead of navigating bureaucratic systems, businesses rely on Deel’s infrastructure to handle regulatory complexity.

Contractor Management Made Simple

Managing international contractors manually increases the risk of:

- Payment delays

- Incorrect tax documentation

- Worker misclassification

- Currency volatility losses

Deel centralizes contractor management, ensuring:

- Standardized contracts

- Timely automated payments

- Transparent invoices

- Local compliance safeguards

For agencies, startups, and SaaS companies, this reduces operational friction.

Global Payroll & Tax Compliance

Payroll mistakes across borders can result in heavy penalties.

Deel addresses this by:

- Calculating local taxes automatically

- Managing statutory benefits

- Handling payroll reporting

- Providing compliance alerts

Businesses gain peace of mind knowing payroll is handled professionally and legally.

Employer of Record (EOR) Explained

An Employer of Record legally employs workers on behalf of another company.

Using Deel’s EOR services allows businesses to:

- Hire full-time employees globally

- Avoid setting up local subsidiaries

- Provide country-specific benefits

- Ensure compliance with labor laws

EOR services are particularly valuable for companies testing new markets.

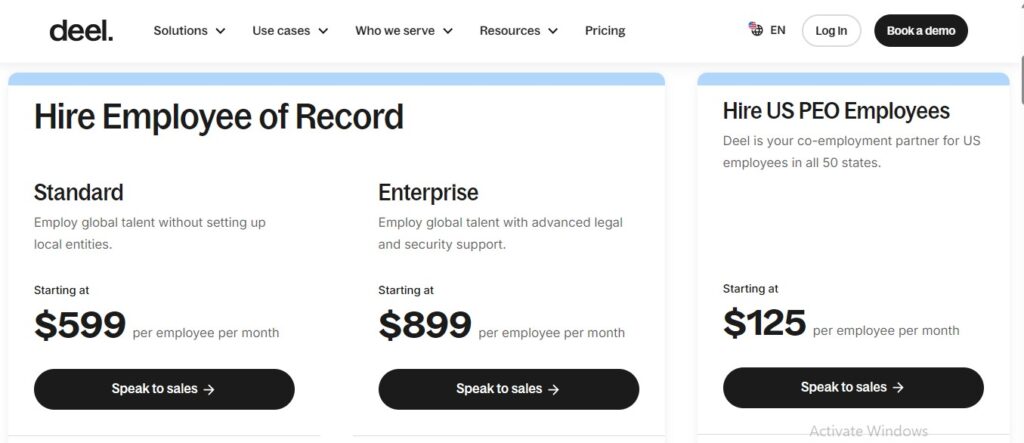

Deel Pricing & ROI Analysis

Pricing varies based on service type:

- Contractor management plans

- EOR employee services

- Enterprise payroll solutions

While costs depend on country and workforce size, many companies report savings compared to establishing foreign entities.

ROI benefits include:

- Reduced legal costs

- Faster market entry

- Lower administrative burden

- Decreased compliance risk

For scaling startups, these savings can be significant.

Integrations That Enhance Deel

Modern companies rely on interconnected systems. Deel integrates with:

- HRIS platforms

- Accounting software

- Expense tools

- Workforce management systems

These integrations streamline payroll workflows and reduce data duplication.

Who Should Use Deel?

Startups

Startups hiring globally benefit from quick onboarding and compliance protection.

Growing SMEs

Small and medium businesses expanding internationally can avoid entity setup costs.

Enterprises

Large organizations use Deel to centralize global payroll and standardize compliance across multiple regions.

Deel vs Competitors

Several platforms operate in the global employment space, including:

- Remote

- Oyster

- Papaya Global

- Upwork

While each platform offers global employment services, Deel stands out for its automation, onboarding speed, and extensive country coverage.

Common Global Hiring Challenges and How Deel Solves Them

Legal Complexity

Deel provides localized contracts and legal frameworks.

Misclassification Risk

Automated classification guidance reduces legal exposure.

Payment Delays

Multi-currency payout systems ensure timely payments.

Tax Compliance

Country-specific tax automation minimizes regulatory risk.

Security and Data Protection

Payroll and HR data require robust protection.

Deel implements enterprise-grade security protocols to safeguard:

- Financial information

- Employee data

- Contracts

- Tax documentation

Trust is a central component of its value proposition.

Optimizing Your Deel Workflow

To maximize efficiency:

- Automate recurring payroll runs

- Use integrations strategically

- Monitor compliance dashboards

- Centralize documentation

These practices improve operational productivity.

Developer & API Capabilities

For tech-driven organizations, Deel’s API enables:

- Custom payroll workflows

- HR system synchronization

- Advanced reporting

- Scalable automation

This flexibility supports enterprise growth.

The Future of Work and Deel’s Role

The future of work is decentralized. Companies will continue hiring globally to access top talent.

Platforms like Deel are shaping this transformation by removing geographic barriers.

As regulatory environments evolve, compliance automation will become even more critical.

Frequently Asked Questions About Deel

Is Deel legit and safe?

Yes. Deel focuses heavily on compliance, security, and lawful global hiring practices.

How does Deel handle taxes?

Deel automates local tax calculations, documentation, and reporting based on country regulations.

Is Deel suitable for startups?

Absolutely. Startups benefit from fast onboarding and simplified compliance management.

Can Deel replace opening a foreign entity?

In many cases, yes especially when using EOR services.

Call to Action

If your company is expanding globally and needs a secure, compliant, and scalable workforce solution, Deel may be the infrastructure you need.

Explore Deel’s platform, compare pricing, and evaluate how it can streamline your international hiring strategy today.

The future of work is global make sure your payroll and compliance systems are ready.